I was talking with a friend the other day, and she was telling me about some big expenses she and her husband had coming up. They had all the money they needed saved in their sinking fund…with extra to spare. But she was having trouble pulling the money out of the account. What if she needed it for something else? How would they build their savings back up in time to reach another goal? This highlighted for me a few of the many reasons it is smart to have multiple savings accounts.

Multiple Accounts Help Give Every Dollar a Purpose

We often hear about giving every dollar a purpose when it comes to creating our spending plan each month. I think giving every dollar a purpose is just as important when saving. By opening multiple savings accounts, one for each of your major goals, you are assigning each dollar in savings a purpose.

With multiple savings account, the purpose of each dollar is clear. The money you save in your emergency fund is designated for emergencies only. You know exactly what you have should you ever need it. But you can also clearly see how much you have towards your next vacation, your future home remodel, or even Christmas presents. This helps alleviate the worry of “what if I need the funds for something else.” The money is clearly labeled. You know exactly what you have for each need or want.

Having Multiple Savings Accounts Helps Keep You Focused

When I was younger, I only had one savings account. Any money I was setting aside for all of my goals, went into this one account. But if something fun or flashy came up, I never hesitated to spend my savings. Even if I originally had another goal in mind. With all of my savings in one place, I lacked focus.

Several years ago, my husband and I decided it was time to save for a house. We opened a high yield savings account and labeled it “House”. It was at a different bank and completely separate from our other checking and saving accounts. Each month we tucked money away and watched it grow. Over time, we found that by separating our house fund from our regular savings we became focused in our savings efforts. We had a goal, and we could see clear progress towards it each month. This motivated us to keep saving.

Having multiple accounts will keep you focused on your goals. You won’t have to worry about accidentally spending money set aside for new tires on your dream vacation. With separate accounts you can ensure that you are saving exactly what you need for each goal.

It Is Easier to Track Your Progress

When saving your money in one account, it is hard know how much you are actually saving towards each goal. If you have multiple accounts, your progress is easier to track. You can set a goal of $25,000 for a house down payment. Each month when you save, you can watch yourself get closer to your goal. There is no confusion about how much you’ve saved towards your different goals. It is clear just by looking at the balances.

It Helps You Save According to Your Values or Timeframe

When all of your savings is in one account, it can be difficult to know exactly what you are saving for each month. This ambiguity can lead to loss of motivation and less follow through. If you have multiple accounts, you can put more of your savings each month towards your highest priority goals. This lets your savings reflect your values and timeframe. By putting the majority of your savings towards the things you want most, you are lining up your saving with your values. This is more likely to create success and sustainable habits in the long run.

A Few Tips for Having Multiple Savings Accounts

If you are going to have multiple savings accounts, there are a few things you can do to help yourself be successful.

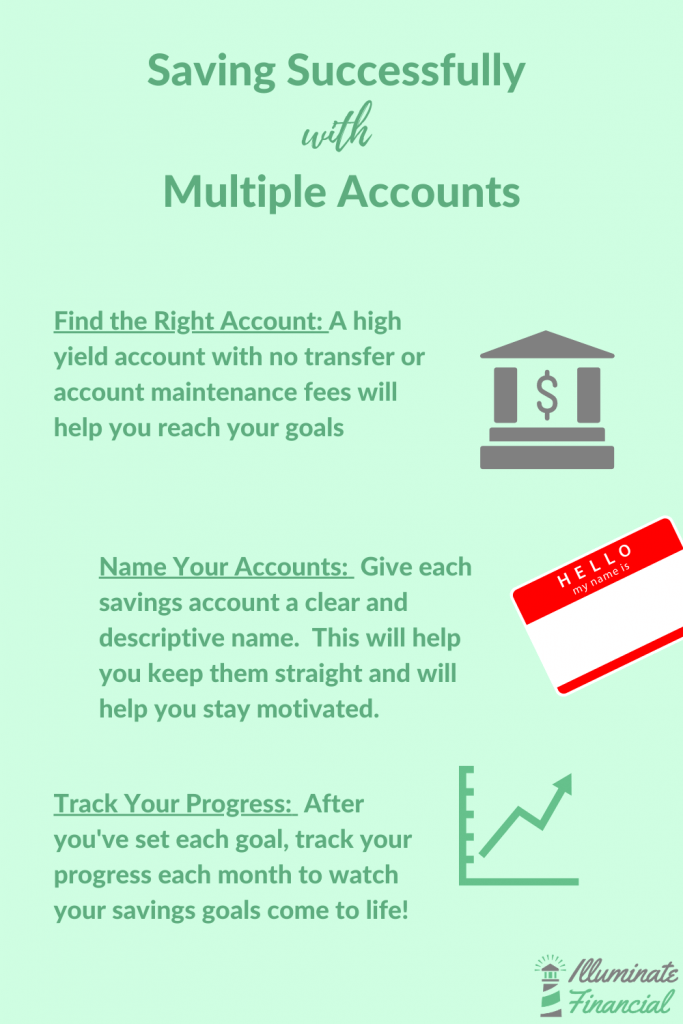

Find the Right Account

Find high yield savings accounts that will earn you interest. People will tell you that by dividing your money into separate accounts you are losing out on earning interest on the full balance. This is true. But I think the benefits of multiple savings accounts outweigh the loss in interest earned. To help make up for it though, open a high yield account for each goal. Be sure the accounts have no fees to make the most of your saving. Also, consider the transfer fees for the accounts you set up. If they are at a different bank, be sure you aren’t being charged to move your money back and forth.

Name Your Accounts

Give each of your savings accounts a good name. The more personal the name can be the better. If I know I’m trying to reach a specific target by a certain date, I often put the date in the name. So “Disney Vacation” becomes “Disney Vacation 2021”. The date and description get me motivated every time I go to make a transfer.

Track Your Progress

Third, set up a system to manage your goals and track your savings progress. Research has shown that you are more likely to reach your goals if you write them down and take concrete steps towards them while keeping yourself accountable. You can track them in Excel, in your planner, in an app, or even on pen and paper. What matters is that you track them in a way that will work for you and keep you accountable. Tracking your progress and clearly stating your goals will help keep you focused.

Final Thoughts

Having multiple savings accounts can help keep you focused and on track. It lets you clearly see your progress and helps you avoid taking money set aside for one goal to fund another. If you want to see major progress towards your saving goals and know each dollar saved has a purpose, I suggest setting up multiple savings accounts.

Are you ready to set up multiple savings accounts buy aren’t sure what goals you should save for? Check out my post about The Six Savings Accounts Every Family Should Have.