As we move into the new year, one thing on most people’s minds is trying to improve upon who they were last year. This improvement can take many forms and can involve all areas of life from health, to fitness, to…you guessed it finance. One thing I try to help my clients focus on as they are starting to take steps to controlling their finances is understanding not just where their money goes, but when it needs to be paid. This organizational step is one of the most crucial, but often overlooked when you are first setting up your budget.

When starting to budget, most people write out their income sources and their monthly expenses, including bills, payments towards debt, and savings. And this is key to setting up a budget. But the timing is also important. Very few people take the time to think about what amount of each paycheck is allocated towards paying which bills or helping achieve savings goals.

What I recommend to clients who are struggling to see the big picture, or who are just starting to set up a budget is to create a bills calendar on their phone or computer. This can be part of their regular calendar or a calendar all by itself. Bills are listed in one color (red in my example) and paydays are listed in another color (green in my example).

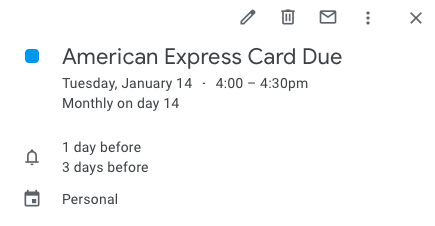

After bills are entered, I encourage my clients to set two reminders for each. I typically recommend the first reminder be set for 3 days prior to the bill due date, and the second reminder be set for 1 day prior to the due date. The first reminder serves as a suggestion to pay the bill in the next few days. The second reminder serves as a warning that, if not paid soon, the bill will be overdue.

I suggest two reminders because it can help reinforce the due dates. It also allows someone to ignore a reminder (because we are all human after all) and not end up with a bill that is past due. I also suggest having the second reminder go off a day before rather than the actual due date to ensure that bills are successfully paid on time.

The system is not perfect. But I have found that it creates a broader understanding of one’s finances and can also give an individual who is struggling to feel empowered in their personal finance battle some of the power back.