Do you ever find yourself getting so fixated on the price of something that you just can’t bring yourself to buy it?

For me, it usually happens with bigger ticket items I’ve already saved for. Last spring my husband and I were browsing tropical destinations and planning our 10th anniversary getaway. Even though we had the money in savings for the trip, and I knew that’s what the money was for, I kept dragging my feet. I was so hung up on the price, that I was forgetting to think about the value.

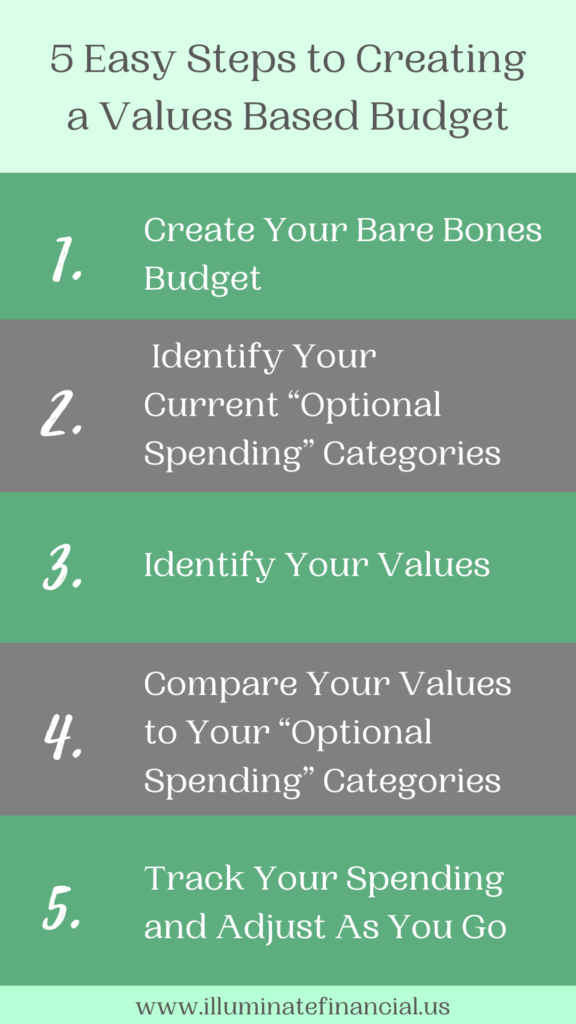

When I started thinking about the value rather than the cost, I could see that the time away, in a new place, with zero responsibilities was exactly what we needed. Making a values based budget can help you focus on what you’re getting and align your spending in such a way that it is easy to make money decisions. Often when people think about sitting down to make a budget, it can feel daunting, but it doesn’t have to. Let’s walk through 5 easy steps to creating a values based budget! But first, what is a values based budget?

What is a Values Based Budget?

In my last blog post, I introduced the idea of building your budget around your values. If you’re new to values based budgeting, I recommend giving it a read before you get started. But, no matter where you are on your budgeting journey, values based budgeting is an important concept to keep in mind. Keeping your values front and center when you are budgeting will help you stay on track as you meet your goals.

Values based budgeting is a method of budgeting where you determine exactly what matters to you and will help you build the kind of life you want. You then use your values to guide your spending, saving, and investing decisions. Having your values at the core of your budget helps you stay on track (or quickly get back on track if you lose your way). With this basic definition in mind here are 5 easy steps to creating a values based budget.

Step 1: Create Your Bare Bones Budget

The first thing you need to do when creating a values based budget is to get acquainted with your essential spending. To do this, it’s best to create a bare bones budget. A bare bones budget is a budget that ensures that all of your essential spending is covered each month. Review your spending for the last four to six months and identify all the expenses that you have each month that keep your life moving. This would include your rent/mortgage, insurance premiums, utilities, internet, debt payments, groceries, medical payments, childcare payments, and anything else you are responsible for taking care of each month. Make a note of each expense, how much it is (if it varies you can take an average), and when the payment is due

Once you have your essential expenses outlined, you’ll want to total up all of your sources of income. Include income from your job, any government assistance you receive, any income from investments you get regularly, or side hustle income. If you share your finances with a partner, include their income too. Subtract your essential expenses from your total income. The result is what you have to spend, save, and invest according to your values.

Step 2: Identify Your Current “Optional Spending” Categories

After you’ve created your bare bones budget, the next step is to look at your optional spending. Review the same four to six months of spending and categorize all the non-essential, or optional, spending. This could be things like drinks out with friends, dinner out, coffee on the way to work, or concert tickets. Any spending that isn’t considered an essential expense will go on this list.

Total up the values in each category for each of the months you review. Then average the spending across each month to give yourself a base line. It’s important to capture all of your optional spending to get a sense for where your money is going each month. This will help you ensure that your spending is lining up with your values.

Step 3: Identify Your Values

Once you’ve identified your essential and optional spending, the next step to creating a values based budget is to identify your values. There are several different ways that you can go about determining what you value. I’m going to walk you through the three I typically use with clients.

Use a List

The first and most common way I think people identify their values is to use a list. The list that I like to have my clients use is Brené Brown’s Dare to Lead List of Values. This list of values also comes with directions to pick two that are most important to you. I usually have my clients pick two to three.

First, read through the list and highlight any and all words that resonate with you. These can be words that drive how you live your life or that you feel you embody. As you do this ask yourself a few questions like, what is important to you? What do you strive to embody for yourself, those you love, or the world? Once you’ve identified the words you relate to most, narrow the list by finding those that are most important to you. It may be hard, but if you sit with it, you will find two or three words that guide what you do and how you live your life. These words will be your core values.

Look at How You Spend Your Time

Another way that you could identify your values is to look at how you spend one of your most valuable resources –your time. Time is one of our truly finite resources, so how we spend it says a lot about what we value and the life we are trying to build for ourselves. Outside of work, how do you use your free time? Are you working out and making mindful eating decisions? Then maybe health is a value of yours. Do you always find yourself in a new place when your schedule is free? Maybe travel and experiences are one of your values. How we spend our time can help us figure out what to spend our money on.

Imagine if…

The final method I use with my clients to help them identify their values is we play an imagine if…game. I give them the following scenario:

“Imagine that you wake up tomorrow in a world where all of your needs are taken care of. The catch is, you still have to work. Because you don’t need to pay for food, clothing, or shelter, you don’t need to earn money. How would you like to be paid?”

In this scenario, you could be paid with virtually anything. It could be in experiences, travel, time off to be with family, incentives to work out, or anything else. What would you choose? Often, when my clients imagine this scenario, it helps them determine what they really value.

Write Them Down

No matter what method you use to determine your values, once you have them, you need to keep them front and center. To do this, it helps to write them down. It can be helpful to keep them in a place where you can see them and you make your decisions. I do this in a few ways to help keep myself focused. First, I have my family’s top three values on our expense tracker. That way each time we are dealing with our money, we are also reminded of our values. I also put pictures of the things that I value on my laptop as the desktop background and as my phone lock screen. These little reminders help me keep focused and moving forward even when I don’t want to.

Step 4: Compare Your Values to Your “Optional Spending” Categories

Once you’ve identified your values, it’s time to look at your spending habits with them in mind. Look specifically at your optional spending categories. Ask yourself how each category reflects your values? Do your current spending, investing, and saving patterns reflect your values? When you are working through this step, it is important to remember that money is a tool and you want to use it to build the life you want. And that is ideally a life that is consistent with your values.

If you identify categories or expenses that really don’t line up with your values, cut them. Other expenses may not be so clear. They may appear neutral. This can be a good time to do a bit of a gut check. How do you feel about the spending? Does the amount feel too high? If so, you don’t have to cut the expense out, but you could cut back. Remember, at the end of the day, you are creating a values based budget that you can stick to. So you need to feel good about the choices you’re making.

Step 5: Track Your Spending and Adjust As You Go

Success! Well…almost.

You’ve taken the 5 easy steps to creating a values based budget. So the hard work is done. Now, each month you need to keep tracking your spending. Always be sure that you are covering your essential spending. Then, work to keep your optional spending in line with your values. The system won’t be perfect. And you’ll get off track. That’s OK! What matters is once you realize you’re off track, you take steps to get yourself back on the plan.

Some people like to track their spending once a month. I personally find that this can be overwhelming. Instead, set aside 30 minutes each week to spend time with your money. Look over the previous week to account for where your money went. Then, look at the week ahead. Do you have any big bills coming up or unplanned expenses you need to cover? This will help you stay more on top of your money and less things will surprise you. Then, once a month you can look at the month as a whole. As you look over your monthly spending, bring out your values list. Think about how your use of money supports your values. And make small tweaks when necessary to keep things in alignment.

A Few Things to Keep in Mind

One of the best things about creating a values based budget is that you are in control. Your budget shifts from being mandated numbers that someone else prescribed to being about you. And having that kind of control keeps you more engaged with your money. You can adjust the budget when you need to. If a certain goal or life event needs to take priority, you can shift spending around to free up the resources you need. This freedom, along with consistent tracking can shift the way you feel about your money. So, are you ready to give creating a values based budget a try? Taking these five easy steps will help you get started! Give it a try today!

Ready to learn more about values based budgeting? Hop on over to my blog post “What the Heck is a Values Based Budget…and Why Should You Use One” and give it a read. Want to learn about how I use my family’s values in our budget? Hop on over to my blog post “It’s About Values” and give it a read.

Are you ready to build a values based budget of your own, but want some support? Schedule a free 30-minute Clarity Call to learn about how financial coaching can help you today!