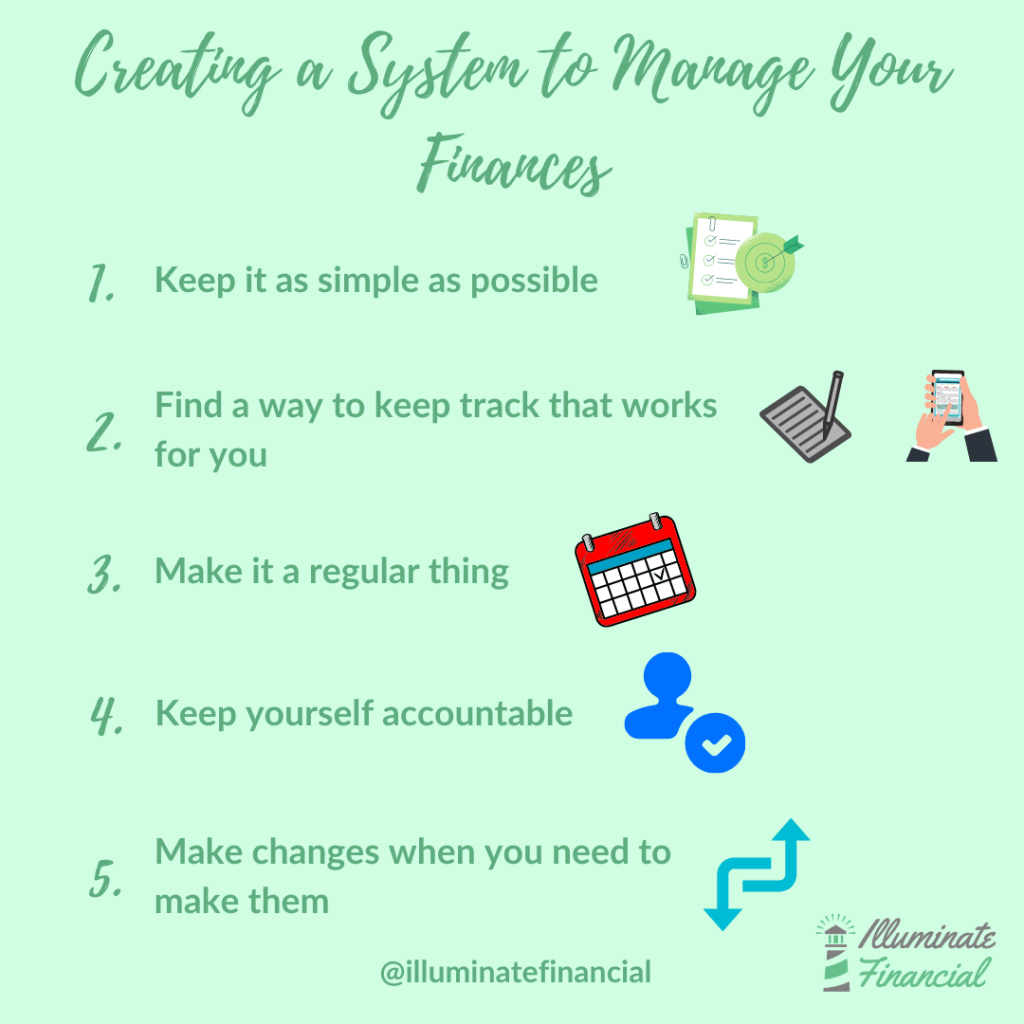

One of the things that I often see overwhelming my clients when they first start coaching is that they have no system in place for managing their money. They are spending money, paying bills, and saving with no real plan. This causes stress and can keep people in the cycle of living paycheck to paycheck. If this is you, and you are ready to break the cycle, it’s time to make your money management easy and stress free. The best way I know to do this is by creating a money management system you can stick to. Here are five things you need to consider when creating your system so that you can use it to thrive.

Keep it Simple

Have you heard of the KISS method? It stands for Keep It Simple Stupid. And this is good advice when you are creating a money management system you can stick to. Make it only as complicated as it has to be. The simpler the better. In the system you create you want to be sure to track the things that matter to you.

A basic money management system should include a way to track your spending, your bills and their payments, debt repayments, and any savings goals you have. But, if that is too much to get started, just track your spending. Over time, as you understand your money you will be able to add more piece to the puzzle. The key is to get started. No one likes a complex system or a long laundry list of tasks. So, keep it simple and start where you are, and you’ll be amazed at the progress you make!

Track in a Way You Will Use

Just like tracking what is important to you, you need to find a system of keeping track of your money that makes sense to you. If you use a tracking system just because it works for your cousin, your sister-in-law, or a gal from church, it may not be the right fit for you. And if it isn’t the right fit, you won’t stick with it or use it to the fullest extent. A huge part of creating a money management system you can stick to is picking the system that works for you. There are SO MANY options!

Tracking Options to Consider When Creating a Money Management System You Can Stick To

You can create an Excel or Google Sheet system for tracking your money. This can let you create tabs for different areas and graphs as well! You can track your financial progress using a journal or a notebook. There are also many different apps that you can use as you are creating your money management system.

Things to Consider When Starting Out

I recommend that you use an active tracking method when you start out. This typically means using a spreadsheet or a notebook. This is because it makes you an active participant in tracking your money. This makes you more aware and allows you to make changes when you start to see a problem.

If you are looking for some simple spreadsheets that you can use to get started, you can download my free debt tracker and savings tracker through my Resources page. If you want a more comprehensive system you can check out other templates I offer here.

Make it a Regular

It is always so exciting when you start creating a new system. You get a new tracker, a new app, or a new notebook. And immediately you fill it and get to work. But then, life gets busy. You forget to update your chart after a debt repayment. And the system slides. One part of creating a money management system you can stick to is to make it a solid part of your life. To do this, you need to make it a regular thing. This means you need to schedule personal finance meetings with yourself.

You are the CFO of your life. And ultimately, you are in charge of your finances. So, you need to build time in your schedule to go over your finances and manage the system to make it work for you. Pick a time where you don’t have other conflicts and usually have time to focus. Sit down with a cup of coffee and focus on your finances. Update your spending, savings, debt repayments, and anything else that you want to track. Keeping it regular will help you focus on your finances. It will also take some of the stress out of your finances because you will have a clear picture of what you have and where your money is going!

Keep Yourself Accountable

In addition to making it regular, you also need to keep yourself accountable. Creating a regular schedule to check in on your finances and your progress is a good first step. Keeping yourself accountable means staying on track. But it also means understanding why you get off track from time to time and taking the steps you need to get back on track.

If you manage your money with a partner you can check in with each other about progress and goals and help keep each other focused. If you manage your money on your own, you can find an accountability buddy who is working on similar goals. Check in with them regularly to help keep you both motivated and accountable. If you can’t find someone to help you with this a financial coach might be the answer. Finding a financial coach you like and trust can go a long way to helping you stay motivated and develop the best strategies for managing your finances. Keeping yourself accountable can go a long way towards creating a money management system you can stick to.

Adapt as Necessary

The final thing you need to do when creating a money management system you can stick to is adapt when necessary. Our lives aren’t always smooth and easy. And things change. In order to create and maintain your system, you have to be able to adapt as well. You need to constantly re-evaluate the conditions in your personal finances. Have you taken on new debt? Do you have big expenses coming up you need to plan for? There will always be things that change in your life, and how you manage your money needs to change too.

If something comes up or changes, don’t be afraid to change your system too. You are creating a money management system that you will stick to. In order to do it, you have to be willing to change what doesn’t work and add in things as you need to. Being willing to be flexible in your methods while not giving up on your goal of creating a system will help you be successful.

Final Thoughts

Creating a money management system is something that will simplify your life, relieve your stress around money, and help you manage it effectively. You just need to determine what matters to you, how best to track it regularly, and keep yourself accountable. If you can do these things, you are going to see results.

If you are ready to set up a system that works for you and want an accountability partner, set up a free 30- minute Get to Know You call to see if Financial Coaching is a good fit for you!

[…] Want more ideas about sticking to your budget, check out my blog post Creating a Money Management System You Can Stick To! […]