Next in my series on personal finance topics that are often scary but don’t need to be, I thought I would talk about how thinking about retirement doesn’t have to be scary. If you’d like to read the first in the series Budgeting Doesn’t Have to be Scary check out my previous blog post!

Nearly half of Americans have no retirement savings. So, I understand why thinking about your retirement can be scary. We all face so many different obligations for our money that finding more to set aside can leave you wondering where exactly to start. And once you are determined to save, the different account options, requirements, and features can become overwhelming. But, thinking about retirement doesn’t have to be scary. When it comes to thinking about retirement, understanding your options, determining your why, and figuring out what retirement means to you can help remove the fear and spur you to action!

Understand Your Options

If you understand your different retirement options, both at work, and on your own, you will learn that thinking about retirement doesn’t have to be scary.

Retirement Options at Work

Do you have a retirement plan offered at work, but you’ve never participated because you don’t understand it or don’t feel like you make enough? If so, understanding your options can help you make good decisions. Set up a conversation with HR at your company to understand your options and how you can sign up. Be sure to ask them about any matching opportunities that they may have. Many employers offer matching contributions. What this means is that if you put in a certain dollar amount or percentage of your salary, they will match it. This is a simple way of saving more for retirement and helping your funds grow quicker. If your employer offers a match, put in what you have to take full advantage of it. Otherwise, you are leaving money on the table.

Individual Retirement Options

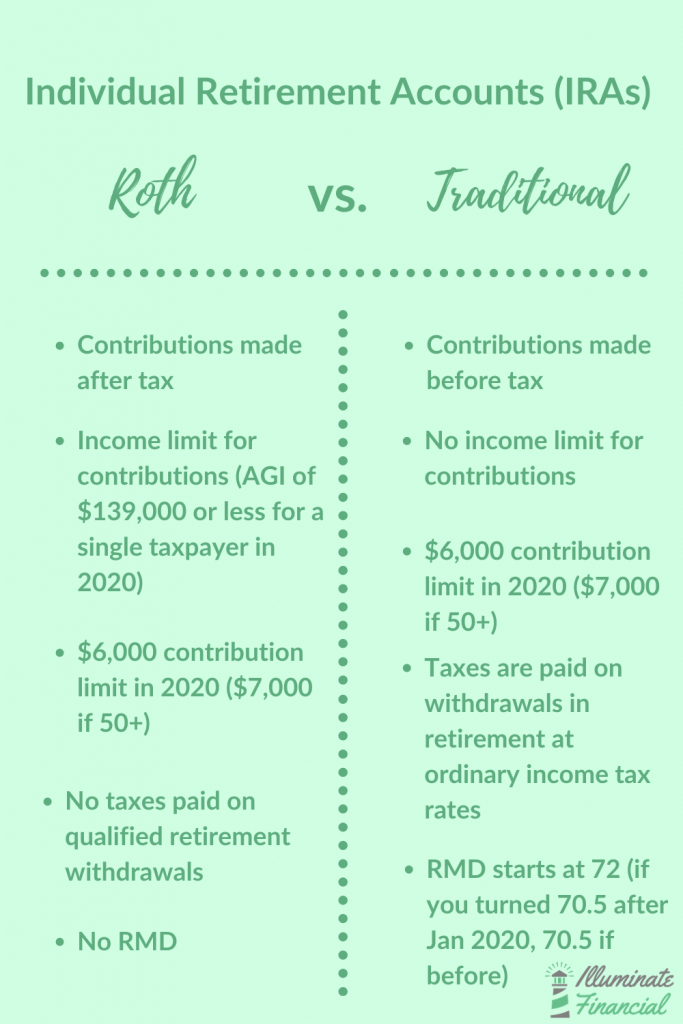

If you don’t have a retirement plan offered through your employer, or are interested in starting your own, it’s good to know your options. There are several different retirement accounts that you can start as an individual to save. The two most common are the Traditional Individual Retirement Account (IRA) and the Roth Individual Retirement Account (IRA). Each of these accounts allows you to save up to $6,000 a year (2020 rules) or $7,000 if you are over 50. The difference is the tax consequences.

Traditional IRA Contributions

Contributions to Traditional IRAs are made with pre-tax dollars. This means that distributions are taxed at your income tax level when they are taken. These contributions to Traditional IRAs also reduce your taxable income in the year they are made. If you take early withdrawals from your Traditional IRA (before the age of 59 ½) you will pay a penalty tax on your withdrawal and it will be taxed at your ordinary income tax rate. And once you turn 72, you must start to take required minimum distributions from your Traditional IRA.

Roth IRA Contributions

Unlike the Traditional IRA, contributions to Roth IRAs are made with after tax dollars. So, distributions in retirement are not taxed. You can also take withdrawals from your Roth IRA at any time tax and penalty free, as long as you are withdrawing the money you have contributed. Roth IRAs also never require you to take required minimum distributions.

For a continued look at the difference between these two IRA options, you can check out this article from CNBC.

While these options can seem confusing, educating yourself on the different types of retirement accounts available and starting to save for your own retirement can go a long way towards showing yourself that retirement planning doesn’t have to be scary.

Know Your Why

One thing that people struggle with when setting aside money for retirement is giving up what they could be spending money on today. It can be so hard to set aside money for the future when we can see ways to spend it on needs or wants now. Putting money towards retirement can be scary because you are giving up that money in your budget now.

To help with this, I think it is extremely important to know your why for retirement. Your why could be so you won’t be a burden to your children. Or, if you don’t plan to have children your why could be so you can take care of yourself. If you value travel, want to relocate to a warmer climate, or have hobbies that you want to pursue in retirement, those can also contribute to your why. Knowing your why will help you see the benefit in forgoing spending today for spending in retirement.

Think about what you want in retirement. What do you want to do? Where do you want to do it? If you have a partner, talk about your goals and create a shared vision for retirement. Then, write it down. Use your why as motivation to talk to HR or investigate individual options and start saving for retirement. If you find yourself wanting to contribute less or withdraw the money now, come back to your why to keep focused. Retirement is another financial goal for many. Having your why written down and clear can help keep you motivated and on track.

Define Retirement

Similar to knowing your why, defining retirement and what it means to you can help make planning for retirement less scary. Today, there are so many different versions of retirement. From the FIRE movement of Financial Independence Retire Early to individuals who turn hobbies into side-hustles and never fully retire, the idea of retiring at 65 and never working again often doesn’t exist. To determine what you need to save for retirement, it is important to define what retirement means in your circumstances. This definition will be personal and might change over time. That’s ok! Having this definition will allow you to do is plan for retirement in your individual context. This can help you see what resources you might need and how you can best achieve your retirement goals.

Final Thoughts

The thought of retirement is scary for some because it means leaving a job that they love. Others can’t wait to have a free schedule and not work anymore. But to reach your retirement goals, what ever they are, you need to have a plan. With so much information, creating this plan can seem daunting. But, planning for retirement doesn’t have to be scary. Educate yourself about your options, determine why you want to save, and define what retirement is to you. Taking these steps should make the process less scary and help you start saving for retirement now. Always remember, it’s not too late to start planning for retirement. As the old sane goes “the best time to start was yesterday. The next best time to start is now.”

If you are ready to start thinking about your long-term goals and want to understand your why so you can reach them, you may be ready for financial coaching. Set up a free “get to know you” call here to learn about your options.