Did you know that Christmas is 18 weeks away? I know, 18 weeks seems like a long time, but it will be here before we know it. And with the holiday season approaching, it is important to start thinking about your creating a holiday savings plan.

Holiday Spending Adds Up:

According to the National Retail Federation’s annual survey, it was estimated that the average American would spend $659 on gifts for family, friends, and coworkers in 2019. A similar poll by Gallup had average holiday spending at $942. Either way, this is a significant amount of money that people spend, often with little to no planning. As these expenses add up, a time of year that is supposed to be filled with peace and love becomes one filled with financial anxiety. What if this year could be different?

The good news is, it can! I am going to walk you through how to create a holiday savings plan so that when December 1st rolls around (or black Friday/Cyber Monday if you’re shopping deals) you are ready to buy the presents while keeping your budget in mind!

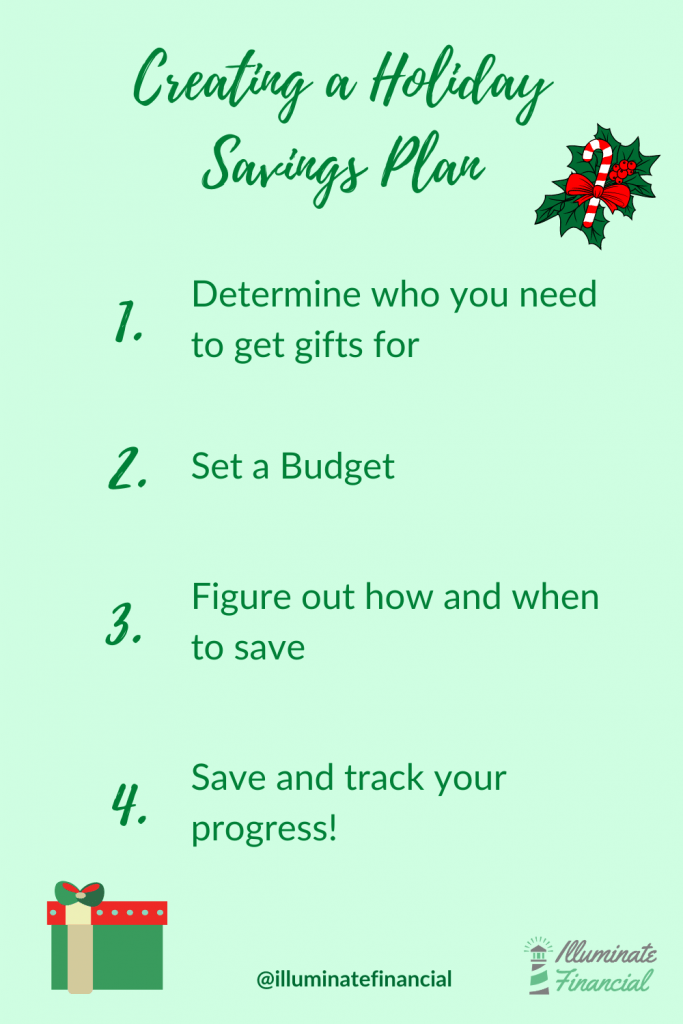

Determine Who You Need to Get Gifts For:

The first step in creating a holiday savings plan is to determine who you are buying gifts for. Think of your family, close friends, work obligations that may require gifts, and anyone else in your life you need to buy a present. I always include our family pets because I like to get them a little something for Christmas morning.

Make a list of all the names and keep it somewhere accessible. I build it in the note’s app on my phone. This allows me to have the list when I am out shopping so I can be sure I buy for everyone on my list. Having it on my phone also lets me update the list with what I’ve bought and how much I’ve spent so I can stay on budget.

Set A Budget:

Now that you know who you need to buy gifts for, it is important to figure out how much to spend. This is a tricky aspect of setting up a holiday budget because there are no real rules. Several places I looked online said that you should plan to spend 1% of your overall household income.

I found another way to determine how much to spend based on an average holiday gift spending of $800 for a family earning $50,000 (median income in the US). This example had individuals compare their income to the median and adjust their gift budget accordingly. Using this method, if you are single and make $25,000 a year, your gift budget would also be half of the average, or $400.

Budget for Each Person:

While these methods provide a place to start, I recommend that you set a budget that feels right for you based on the person you are buying gifts for and your financial circumstances. My husband and I set our budget for holiday gifts (and gift giving in general) based on our relationship with the person and the occasion.

Once you have your budget established, I recommend writing down the amount you are going to spend on each person next to their name on the list you created at the beginning. This gives you a target when you are shopping. Remember, you don’t have to spend the full amount on each person but try your best not to go over.

Determine Your Total Budget:

After you’ve budgeted for each person on your list, total up the amount you plan to spend on gifts. Knowing the total that you want to spend will help you spread your spending out over time. It will also allow you to see how much you are spending on gift giving for the holidays to ensure that this lines up with your values and other financial goals.

Figure Out How and When to Save:

Now that you know how much you need to save before you start Christmas shopping, you can determine how much you need to save to make it happen. I recommend saving weekly so that you can put away smaller chunks of money each time. If another interval of saving works better for you, that’s ok. Just find what works for you and your budget so that you can reach your goals.

To determine how much to save each week, divide your total holiday gift budget by the number of weeks until you want to start Christmas shopping. I created a free savings tracker that you can print out and color in as you save.

The goal for this coloring sheet is $50 a week over 13 weeks, which would give you $650 to spend on gifts. If you use this sheet, start saving the first week in September to have your $650 saved by December 1st.

Now that you know how much you need to save each week, review your normal budget. Adjust your budget to allow for saving your allotted amount. You may have to change some of your discretionary spending while you save for the holidays, but that’s ok. Saving in advance will allow you to be ready when it is time to buy gifts. This can minimize budget disruptions down the line, so small adjustments now are worth it.

Save and Track your Progress:

Now that you’ve figured out how much you are saving, and in what intervals, it’s time to get started. Each week, set aside the amount of money you’ve allocated to reach your holiday savings goal! When you save the money, be sure to track it. You can use the free printable savings tracker, Excel, Google sheets, an app on your phone, or even a pen and paper. Just be sure that you are tracking your savings so you can follow your progress and be ready to shop! If you want more help with saving and a pre-built tracker for Excel and Google Sheets, take a look at my Personal Savings Tracker.

Where to Save:

There are several places that you could choose to save for your holiday spending. You could put it in your regular savings account, a high yield savings account, or even save it in cash in an envelope. Personally, I like using a high yield savings account or a savings envelope. This removes the money from my regular savings, and it becomes an out of sight out of mind situation so that I don’t spend the money on something other than Christmas gifts. If you’ve never considered using a savings envelope to save money, check out my blog post on how to do it!

Saving with Gift Cards:

One method that I am going to try for our family this year is saving for Christmas by buying gift cards. These are not gift cards that I will give out, but rather gift cards I will use to buy gifts when I am out shopping. I plan to buy gift cards to Amazon and Kohls, which are the two main places we do our shopping. When I start buying presents, I will use the gift cards instead of cash or my debit card to make the purchases. I like this idea because I know where I will buy the bulk of my presents and leftover money on the cards can continue to be used for gifts in the future.

Final Thoughts

The Holidays come every year, and we know that with the season we will also spend more money. But yet, it can so often take us by surprise and cause us to lose sight of our budget and our goals. By taking a little time now to plan for our holiday spending, we can cut down on the anxiety of the season and feel more prepared. Set up a holiday savings plan today to make your holidays worry free!

Do you save for the holidays? If so, where do you save your money and how to determine your budget? I’d love to hear from you!

[…] you want to create a plan to save for Christmas next year, check out my blog post Creating a Holiday Savings Plan. This can help you create a plan for your holiday spending so that it doesn’t sneak up on you […]