When you tell someone you’re saving for a house, chances are you mean that you are putting away your hard earned money to be able to make a down payment on the home of your dreams. You’ve probably even set up a special house savings account. But once you’ve made the down payment and have the house, you’re done saving for your home, right?

Not quite!

Owning a Home is Expensive!

According to a study conducted by Zillow and Thumbtack homeowners can expect to spend around $9,390 each year in costs related to owning and maintaining a home (this figure includes property tax, utilities, and homeowners insurance in addition to ongoing maintenance).

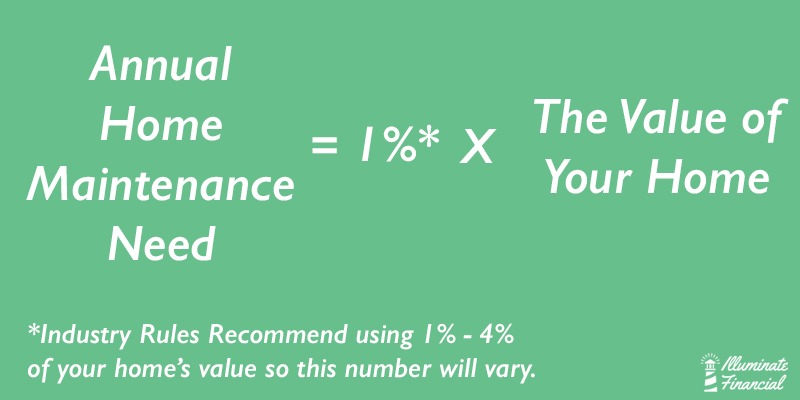

The rule of thumb in the industry is that a homeowner can expect to spend 1% to 4% of the value of the home each year in maintenance costs. This means that on a home with a value of $217,600 (the average home value in the US), you could expect between $2,176 and $8,704 per year of maintenance costs! Trying to come up with this money when the need arises can be difficult and can force homeowners to use credit or their emergency fund for expenses that, while pressing, are not true emergencies.

Earmarking Funds Can Help:

This is why I recommend that homeowners set aside a portion of their savings to their home. Do this by setting up a separate high-yield savings account specifically for the house, or by allocating a certain portion of a savings account towards home repair and maintenance. Depending on home values and the cost of maintenance in your area, how much you should set aside will vary.

You can also choose to expand this fund beyond simply maintenance costs and include things like property taxes and insurance, if applicable. You could also include updates and remodeling projects that you’re planning. The amount you will need will also depend on whether or not you have a mortgage. If you have a mortgage, chances are your property tax and homeowner’s insurance are already included in the payment.

Determining How Much to Save:

It can be hard to know exactly how much to save, especially if you are a first-time homeowner. So, when determining how much you need to set aside each year for your home there are a few things I suggest you consider. First, were there any issues noted on the home inspection, like an aging water heater or furnace, that don’t need to be addressed now but will need to be fixed in the near future? If so, you can price these repairs or replacements out and based on the timeline for fixing them determine how much you will need to make those repairs.

Next, you can talk to friends or neighbors who own homes in similar areas and see what maintenance issues they run into and the associated costs. Remember though, all homes and situations are different.

Finally, are there any upgrades or remodeling projects you are planning to take on in the next several years? If so, you can work to price out these changes and factor them into your saving as well. Remember that prices will change over time, so for the most part determining how much to save is a guessing game. When in doubt, you can go back to the industry standard of anticipating that home maintenance will cost you 1%-4% of your home’s value annually. But, even if you underestimate, having money saved to help specifically with household repairs and maintenance will help you in the long run.

Breaking the Savings into Manageable Chunks:

Once you have decided on an annual amount, it is time to break this number down further into more manageable chunks. I think the most useful savings time frame is to determine what you need to save each month. To do this, you can take the annual amount that you want to save for your house and divide by 12 to determine how much you should save each month to manage the repairs and maintenance.

Planning for Longer Time Frames:

If the project or repair is more than a year out, you can always divide it by the number of months until you need the funds to expand your savings projections out. For example, if you are going to need a new water heater and you estimate it will be three years before you need it, that means you have 36 months to save (3 years x 12 months a year). If you estimate that the project will require $2,500 total, you would need to save $70 (I rounded up from $69.44) per month into your house savings account for the next 3 years to be able to pay for your water heater when it’s time to replace it.

Rounding Up:

One important thing to note, in the example above I rounded the amount up. I would recommend doing this because first, it is tricky to remember to save $69.44 a month. Second, if you round up you are building in a small safeguard for increased costs. It’s also important to note that these simple equations are not factoring in interest that your savings account may earn. Savings accounts are earning less interest now than they used to, but if you have a high-yield account set aside for your house you can factor in the interest, or you can leave it out and again build yourself a bit of a buffer against rising prices.

Final Thoughts:

It’s easy to lose yourself in the math or the “shoulds” for a situation like this. It can be tempting to sit down and try to pencil it all out, then give up because it’s too tedious or you realize you can’t predict everything so why even bother. But I encourage you to try to set aside some money for your home after you’ve purchased it. Having funds available to pay for repairs or issues that don’t decrease your emergency fund or derail your progress on other financial goals will bring you peace of mind. And even if your savings doesn’t cover an entire unexpected repair, having a buffer is always nice. Anytime you’re preparing for future expenses by saving, just remember what Benjamin Franklin said “Failure to plan is planning to fail.”

If you already own one home and are thinking of purchasing a second or vacation home, take a look at these additional resources.

A Bankrate article on the cost of owning a vacation home.

Or this article on owning a home from afar.